Now Reading: 5 Best Accounting Software For Self Employed

- 01

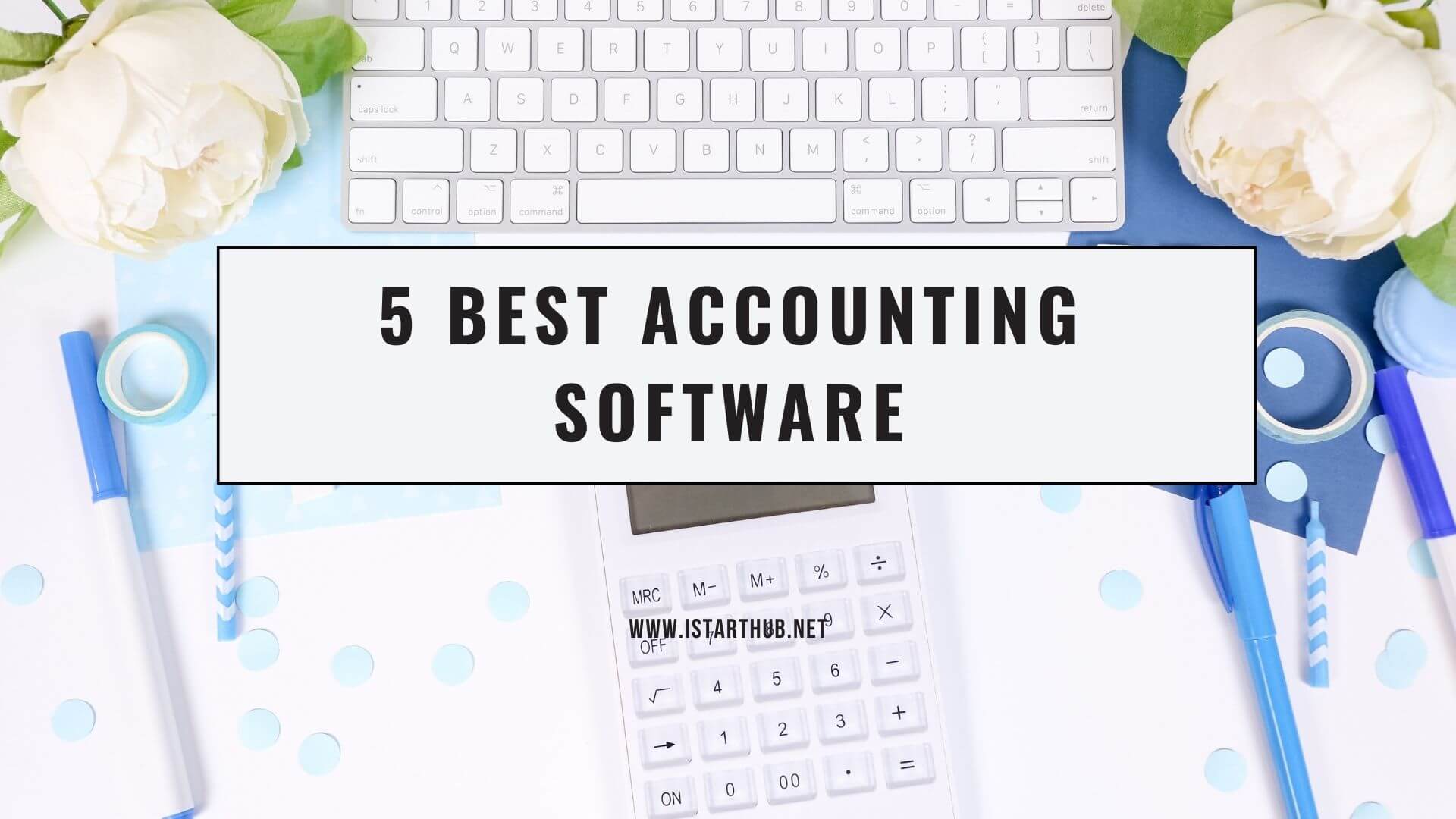

5 Best Accounting Software For Self Employed

5 Best Accounting Software For Self Employed

The overall purpose of accounting is to systematically record, analyze, and report financial transactions and activities to have a clear picture of a business’s financial health. Small business owners and self-employed people frequently struggle with handling their finances effectively, which causes confusion, mistakes, and stress. Finding the right tools to automate accounting processes is essential for keeping accurate records and making wise financial decisions.

Spending hours performing calculations and going through mountains of receipts can take a toll on anyone. As a freelancer, you need reliable accounting software that simplifies managing your finances and frees up your time to focus on your company’s growth.

The best self-employed accounting software offer features ranging from monitoring expenditure to tax preparation. They are designed to satisfy all your needs, whether you’re self-employed, a consultant, or a small business owner. In this article, we’ll delve deeper into the world of the best accounting software for self-employed people. So, let’s get right into it!

What is the Best Self-Employed Accounting Software?

The best accounting software will completely shift how small business owners and self-employed people control their finances. Self-employed accounting software proves to be efficient by streamlining tasks, keeping accurate records, and providing essential insights to help you make informed decisions.

These tools are useful for start-ups and small-scale organizations due to their personalized offerings. They not only automate invoicing, taxes, and revenue management but they also monitor costs, save up time, and reduce stress. Accounting software serves as a virtual financial advisor while also crunching data and providing necessary information to people who don’t possess extensive financial backgrounds.

5 Best Accounting Software

Are you a self-employed individual, consultant, or small business owner looking for the best accounting software out there to take control of your finances? Well, look no more. We have researched and created a clear overview of the leading rivals among online accounting software providers.

Our list contains the top 5 best accounting software based on:

- Ease of use

- Functionality

- Customer Reviews

- Features

- Pricing plans

So, let’s take a look at the list of the best accounting software of 2023:

1. FreshBooks Accounting Software

Let’s start with the best accounting software! FreshBooks accounting software is a desktop accounting software that meets the demands of intelligent entrepreneurs in the changing world of business administration. It recognizes the necessity of protecting your assets and keeping a tight hold on your financial situation. This cloud-based accounting software is painstakingly created to provide the highest level of protection for your priceless data.

Your business will be protected virtually with this billing software and state-of-the-art secure servers.

Top Features

From managing invoices to tracking time – FreshBooks accounting software does it all! It has many features but a few of them are the backbone of this self-employed accounting software. They are:

- Sales Tax Summary: By keeping track of both taxes paid and received throughout any period, this feature makes sales tax administration simple. This function simplifies remittance calculations and gets rid of extra work.

- Invoice Details: It provides you with information about your invoicing activity. Helps you keep an eye on your financial records, and customize reports by date, customer, and payment status.

- Expense Reports: These provide a breakdown of costs over a certain period, and can help you better understand your company’s spending habits. Your resource allocation is kept up to date with this feature.

Also interesting: Best Ideas On Businesses That Run Themselves

Pricing

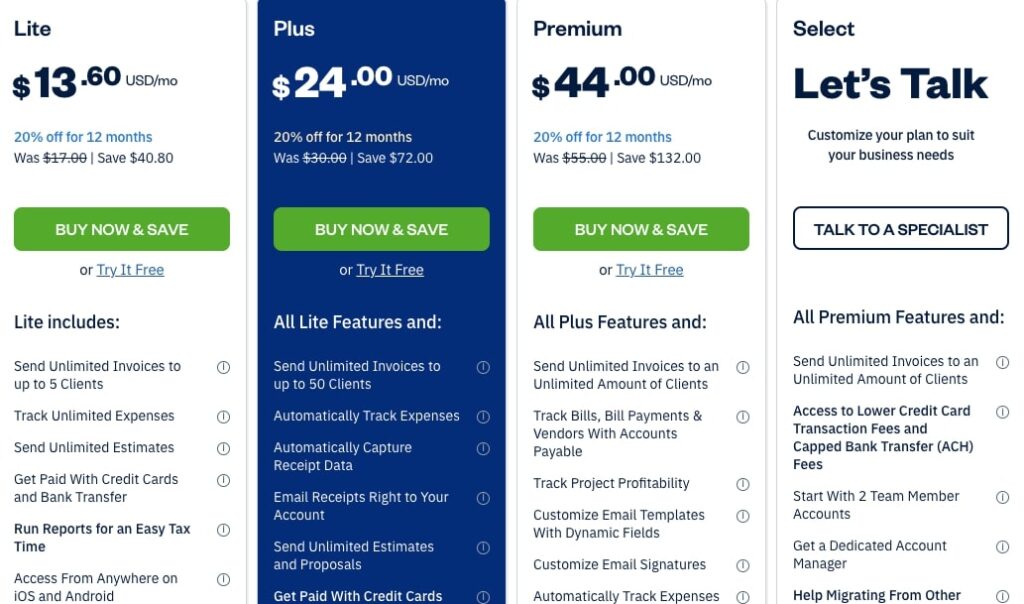

To meet a range of business sizes and needs, FreshBooks provides four plans, starting from $13.60 a month. Additionally, with a 30-day money-back guarantee- you can always get a refund if you aren’t satisfied with your plan.

- Lite: At $13.60/month, with 20% off for 12 months, this plan lets you send unlimited invoices to 5 clients.

- Plus: This plan costs $24/month, with 20% off for 12 months, letting you send an infinite number of invoices to 50 clients in addition to all features of the Lite plan and some other features.

- Premium: Costing $44/month (20% off for 12 months), the premium plan allows users to send unlimited invoices to an unlimited number of clients. It offers many new features with the features of the Plus plan.

- Select: Customizable plan with advanced features and services, offering a huge number of features and add-ons.

The product is best for

FreshBooks accounting software is best for coaches, consultants, or any self-employed people looking to transform the way they handle money. With this cloud-based solution, you can improve the efficiency, security, and support of your business operations.

2. Sage Accounting Software (formerly Peachtree accounting software)

Sage is a full-featured financial management solution and accounting system for self-made people. It was also known as Peachtree accounting software in the past. Today Sage is a top accounting software for small business. With its configurable bookkeeping programs, it helps users manage their finances. Sage’s user-friendly interface and extensive functionality assist users in taking control of their accounts.

Top Features

Sage has many user-friendly features, but a few of them shine through, such as inventory management, invoicing, financial reporting, and multi-currency solutions. These features help self-employed people manage their finances by reducing errors and operational costs.

- Inventory Management: This feature makes it easier to track, value, and manage stock accurately. It guarantees effective stock control and minimizes mistakes. With inventory reports and forecasts, it also assists users in making informed decisions.

- Invoicing: Users can create and track expert invoices quickly and easily using this feature. It streamlines the billing process and guarantees prompt payment collection.

- Multi-Currency Solutions: Sage’s multi-currency capability makes it easier for individuals involved in international transactions to manage multiple currencies smoothly.

Pricing

Sage provides plans starting from $10, designed to meet varied demands. It is a cost-effective option since the pricing structure guarantees that consumers only pay for the services and capabilities they require.

Sage Accounting Software offers two plans, namely; Sage Accounting Start and Sage Accounting.

- Sage Accounting Start: With $10 per month, this plan is ideal for entry-level needs. It includes functions such as invoice creation and transmission, tracking unpaid bills, and automated bank reconciliation.

- Sage Accounting: This plan is offered at a discounted rate of $7.50 per month for the first six months (or 70% off the typical price of $25). This package adds capabilities including automatic receipt capturing (free for three months), support for unlimited users, quotations and estimates, and cash flow forecasting. It also contains all the features of Sage Accounting Start.

The product is best for

Sage is best for self-employed people, consultants, and small company owners that want an effective and feature-rich financial management solution. Its flexibility meets various company demands, whether you’re handling invoicing, projecting cash flow, or tracking inventory, making it a standout option.

3. Patriot Software

Particularly designed for freelancers, small firms, consultants, and nonprofits, Patriot Software stands out as a reliable and user-friendly accounting solution. Patriot provides many tools to make your financial management responsibilities easier, with an emphasis on efficiency and accuracy.

Top Features

With a plethora of features, Patriot is one of the best accounting software for nonprofits. However, some of its features manage to stand out by making the software robust and efficient. They are:

- Patented Dual-Ledger Accounting: This feature guarantees that your financial records are consistently correct and balanced, lowering the possibility of mistakes and conflicts.

- Financial Reporting: It enables you to delve deeply into your financial data. Transactions, trends, and performance measures may all be analyzed to help with strategic planning.

- Invoicing Solutions: It creates professional invoices tailored to your business, and sent straight to clients from the site. With infinite invoice generation capacity, your billing procedure will be streamlined.

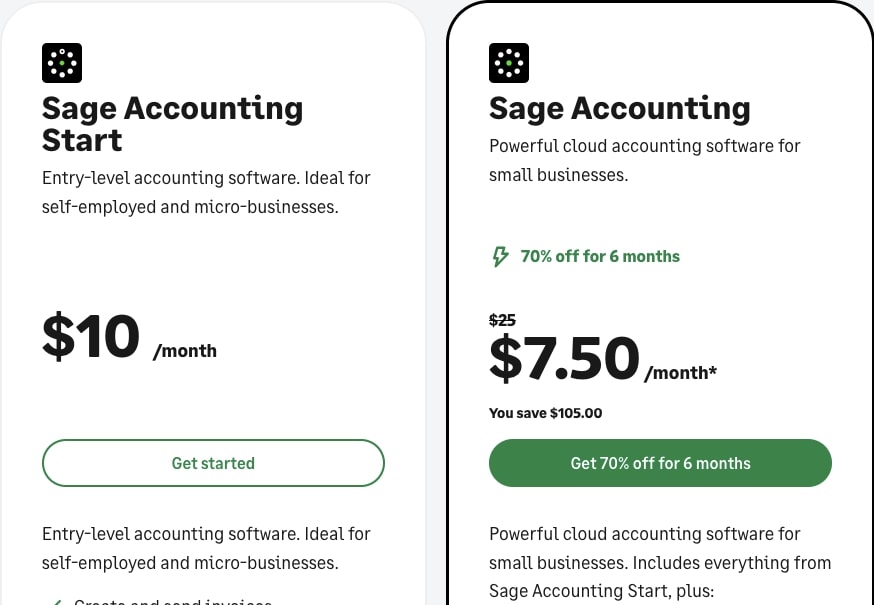

Pricing

Patriot offers two plans for its users, starting from $20 a month, named Basic and Premium. Differentiated by a few features, these plans offer:

- Basic: This plan, which costs $20 a month, helps users keep tabs on the fundamentals of money input and outflow.

- Premium: The $30/month plan has all the features of the Basic plan and more. It gives you the resources you need to handle invoicing, cash flow, and company spending efficiently.

The product is best for

For anyone looking for an all-inclusive but user-friendly accounting system, Patriot Software is the best option. Its features are designed to meet the needs of individuals who want precise financial tracking, expert billing, and analytical reporting. Patriot Software provides the knowledge and resources necessary to simplify your financial operations.

4. Wave Accounting Software

With Wave, managing your finances is easier and more effective, freeing you to concentrate on what matters: expanding your company. For self-employed people and owners of small businesses, it emerges as a trustworthy ally by providing a simple platform for efficient financial management. Its unrivaled benefit is that it offers limitless income and spending tracking, making it simple for you to keep track of your money coming in and going out.

Top Features

Wave’s top-notch features make accounting for users a piece of cake. The best of its features are:

- Unlimited Tracking: It provides you with a view of your finances and tracks every transaction, from payments to expenditures. With this feature, any of your data will not go overlooked.

- Easy Collaboration: This feature lets you keep your team in sync, speeding up decision-making and financial planning. You can add partners, colleagues, or accountants easily.

- Instant Insights: You can easily determine if your current prices are adequate and if your pricing strategies are efficient with this feature. The dashboard is crafted to provide users with instant access to financial data.

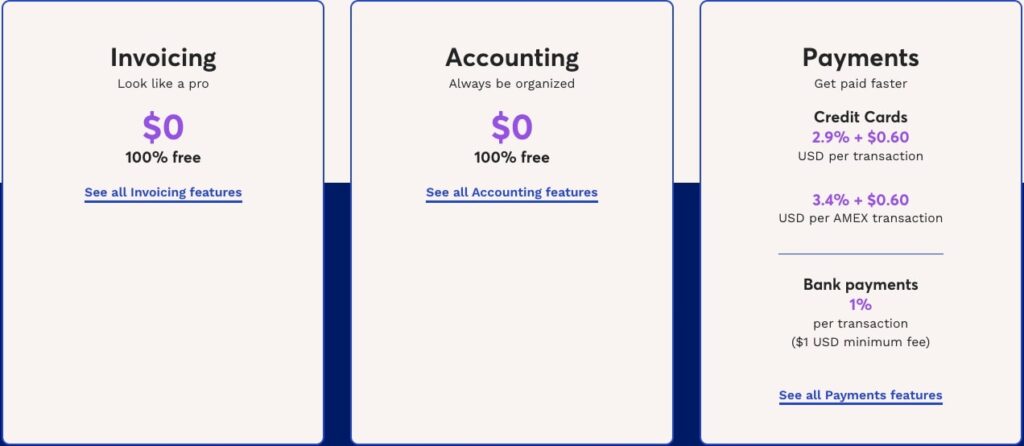

Pricing

Wave offers free accounting services, making it one of the best accounting software for consulting business and self-employed individuals.

The product is best for

Wave combines powerful functionality with a simple user interface and makes these functions available without charge. It is a standout choice for those seeking a solid accounting software solution that won’t break the bank because of its collaborative features, unrestricted revenue and expense tracking, quick insights, and comprehensive reports.

5. Xero Accounting Software

An all-rounder accounting software option for freelancers, consultants, and small enterprises is Xero. What sets Xero apart is its user-friendly interface and a plethora of features made to make managing your finances easy. With Xero, you’re in command of your company’s current and future financial health rather than just managing the statistics.

Top Features

With Xero’s user-friendly offerings, you can handle your finances on your terms. The best features of this accounting software are:

- Online Invoicing: With this feature, you can easily issue invoices, set up reminders, and manage payments. Your business operations will continue to function smoothly and the administration of your invoices will coincide with your timetable.

- Analytics: It enables you to keep an eye on important data, assess your financial status, and get a glimpse of your projected cash flow.

- Accounting App: With the app, you can manage your funds, issue invoices, and access your financial information from anywhere.

Pricing

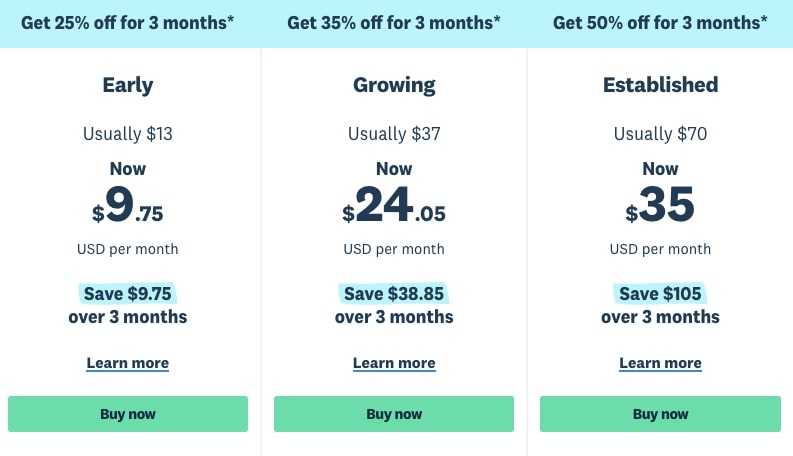

The price choices for Xero are created to coincide with the growth trajectory of your company. With a 30-day free trial and plans starting from $9.75 per month, Xero offers the following:

- Early: Usually $13, this plan costs $9.75 with 25% off for 3 months. It offers all the basic features, including online invoicing (20 invoices and quotes), bill payments of up to 5 bills, and bank reconciliation.

- Growing: With 35% off for 3 months, this plan will cost you $24.05 instead of the usual $37. It offers all features from the Early plan but invoicing and bill payments are unlimited.

- Established: This plan costs $35 instead of $70 with 50% off for three months. Offering all features from the plans above, it also provides multi-currency, analytics plus, project tracking, and more.

The product is best for

The distinguishing quality of Xero is how seamlessly features are integrated with a user-friendly interface. It eliminates the barrier between intricate financial operations and simple navigation. Xero gives you the resources you need to make wise decisions, enhance cash flow, and promote development.

What is Accounting Software Used For?

Accounting software is the digital cornerstone for effective financial administration in various industries. Fundamentally, it enables error-free tracking of revenue and expenditures by doing away with human data entry. It provides complete insights into your financial health through configurable reports and dashboards, going beyond simple record-keeping and assisting in decision-making.

The program streamlines tax preparation during tax season by producing accurate financial statements and classifying deductible costs, assuring compliance while maximizing deductions. Additionally, it facilitates prompt billing, payment monitoring, and effective cash flow management. Accounting software essentially converts complicated financial operations into manageable routines, freeing you up to concentrate on what counts — ensuring the success of your company.

What accounting software do large companies use?

The choice of accounting software depends on the company’s needs and industry. Such accounting software solutions are usually more complex and customizable to accommodate the unique financial requirements of large enterprises. Some of the top accounting solutions are:

- Oracle Financials Cloud: Part of the Oracle Cloud suite, it offers a wide range of financial management and reporting.

- FreshBooks Accounting Software: It offers features that simplify accounting and streamline financial tasks.

- Microsoft Dynamics 365 Finance: A financial management solution that integrates seamlessly with other Microsoft products.

Conclusion

An absolute necessity for self-employed individuals and small enterprises is effective financial management. On this trip, the five best accounting software options—Sage, Patriot, FreshBooks, Wave, and Xero—serve as pillars of support. Sage has a wide range of features, Patriot creates solutions specifically for each client, FreshBooks specializes in invoicing, Wave provides user-friendliness, and Xero effortlessly combines simplicity and power.

You deserve to have tools that work just as hard as you do whether you’re self-employed or a small company owner. The right accounting software simplifies complicated financial responsibilities, freeing you up to concentrate on developing your company. These accounting software alternatives are therefore your dependable companions on the road to financial success, whether you’re just starting or are an established business.

Tetiana is a business coach and owner of IStartHub, a business media for ambitious female entrepreneurs and small business owners.