Now Reading: How To Register Your Business: 9 Simple Steps To Get An LLC For Beginners

- 01

How To Register Your Business: 9 Simple Steps To Get An LLC For Beginners

How To Register Your Business: 9 Simple Steps To Get An LLC For Beginners

If you are a beginner, forming an LLC may seem like a complicated process. I have also started my coaching business and understand how you may feel. However, the benefits of getting an LLC outweigh the cost and hassle of setting up one. And it doesn’t require any initial formation fee! So, how to get an LLC? If you are confused about requirements, let’s get into the details and learn the essential things about how to open an LLC.

Affiliate Disclosure: Some of the links in this article are affiliate links. It means that if you buy through these links, we may earn a small commission to support this website at no cost to you.

What is an LLC?

LLC stands for “Limited Liability Company” and is a business structure that works in the U.S. It protects its owners from personal responsibility for any debts that a business sustains. However, each state has its regulations for business structure.

How does an LLC work?

If you intend to wet your feet in business, a Limited Liability Company would be a great option. Unlike a partnership and a sole proprietorship, the owner of an LLC is called a member. There is no limit on several members. However, some states allow “Single-member” LLCs, that have only one member. Also remember, some businesses are not allowed to be LLCs such as insurance companies and banks. Therefore, it is important to check all the requirements with the state.

To get an LLC, you don’t need a formal company.

How much does it cost to get an LLC?

Getting an LLC doesn’t have to be expensive. In fact, it’s possible to form an LLC with little to no cost, especially if you use services like ZenBusiness.

To understand how to get your LLC and the fees associated with it, let’s go through them:

- State Filing Fee

- Registered Agent Fee

- Name Reservation Fee (Optional)

- Publication Fee (Only in Some States)

- Business Licenses and Permits

- Operating Agreement

- EIN (Employer Identification Number) Application Fee (Optional):

- Annual Report Fee

These fees may vary by state and locality. The companies, like ZenBuisness or Swyft Filings, offer packages that cover all these costs. Nevertheless, you may check with financial professionals to understand the requirements for maintaining an LLC in your area.

9 Simple Steps to Form an LLC for Dummies 2023

What are the steps to starting an LLC? Here are 9 key steps you should follow to get your LLC:

- Select a state

- Choose a name for your LLC

- File Articles of Organization

- Choose a registered agent

- Decided on member vs. manager management

- Create an LLC operating agreement

- Comply with other Tax and regulatory requirements

- File Annual reports

- Out of State LLC registration

1. Select a State

What is the best place to form an LLC? I firmly believe that your location can be the best state for an LLC when you work with the right LLC provider (the details are below in the article).

However, if you still deciding on the best state to open an LLC, you know that the requirements vary slightly from state to state. Let’s dive deeper into the topic.

Best state to form LLC for online business

When I started my journey and searched for the best state to form LLC for online business, I carefully considered the following factors:

Business-Friendly Environment

Choose a state that offers a business-friendly environment, including low regulatory burdens, favorable tax policies, and minimal bureaucracy. States such as Delaware, Wyoming, and Nevada often rank high in these aspects, attracting many entrepreneurs.

State Taxes

Taxation can significantly impact your LLC’s profitability, so it’s crucial to evaluate state tax rates, including income tax, sales tax, and property tax. States like Alaska, Florida, and Texas are known for their favorable tax environments with no income tax, making them attractive choices for many business owners.

Legal Protections

The level of legal protection offered to business owners can vary from state to state. Some states have robust laws in place to shield LLC owners from personal liability, while others may have weaker protections. Understanding the legal landscape and the potential risks involved is crucial to safeguarding your personal assets.

Privacy and Confidentiality

For certain businesses, privacy and confidentiality are paramount. States like Delaware and Wyoming have provisions that allow for greater privacy by allowing the use of registered agents, thereby keeping sensitive information confidential.

Administrative Ease

The ease of doing business is another vital factor to consider. Some states have streamlined processes for LLC formation, annual reporting, and compliance, reducing administrative burdens and saving valuable time and resources.

Once you decide your state, move to the next step which is choosing a name for your LLC.

2. Choose a name for your LLC

Choose a name for your company considering the state’s rules. However, one thing common is that your LLC’s name ends with an LLC designator, such as Limited Liability Company or Limited Company, or an abbreviation of these phrases. Also, the name must be new, not the same as the name of another business entity registered with the state you have chosen.

Follow these guidelines for your LLC name:

- Must include “Limited Liability Company’’ or LLC

- Not include the name that can be confused with a government agency (FBI, State Department, etc.)

- Avoid restricted Words ( bank, Attorney, University)

- The name must be distinguishable from any other limited liability, corporation, or limited partnership

If you are planning to register after a year, you can reserve your LLC right away online.

3. File Articles of Organization

Articles of the organization are filed with your state’s corporate filing office, often the Secretary of State. Some states use the term “Certificate of formation” instead of articles of organization. Meanwhile, the State of Massachusetts and Pennsylvania call the document “Certificate of the Organization”. Article of Organization is available online or you can access the form on your Secretary of State’s website. For the form, you need your LLC’s name, the name, and address of its registered agent, and other basic information. There is a small fee for the article which varies from state to state. Mostly start with $100.

4. Choose a registered agent

A registered agent is an individual or company that agrees to accept legal papers on behalf of your LLC if it is issued. Also, receive important tax forms and legal documents. The registered agent must have a physical state.

Who can act as a registered agent?

A registered agent must be a resident of the state or corporation and authorized to transact business in the same state. Some commercial registered agents act as an agent and take a fee for the services. For example, ZenBusiness and Swyft Filings. An LLC member can act as a registered agent for the limited liability company.

5. Decided on member vs. Manager Management

LLC follows two basic business structures including the member-managed and manager-managed company. It depends on the choices, if it’s a small company, a member-managed structure will work out. In member-managed, members are able and willing to be involved in the day-to-day decisions and operations of the business. However, in a manager-managed structure, members do not wish to be involved in day-to-day affairs, and the company chooses managers out of business.

It is incredibly important for your business, therefore, you must spend time before making the choice.

6. Create an LLC operating agreement

A simple LLC operating agreement is an internal document that outlines the duties of members and ownership. It is not required officially. However, it is recommended to create one, otherwise, the state will create one. There are six main sections of the document which include details about;

- Organization

- Management and Voting

- Capital contribution

- Distribution

- Membership Changes

- Dissolution

7. Comply with other Tax and regulatory requirements

These are additional taxes and regulatory requirements that can be applied to your LLC:

– EIN (Employer Identification Number)

It is also known as Federal Employer Identification Number (FEIN), or Federal Tax Identification Number (FTIN). It works like social security number for your LLC. If you are a single owner, you will need an EIN to hire more people or to open a bank account.

– Business Licenses

It depends on the state and location where your business is registered. You can check with state agencies to ensure your business is registered, licensed, and permitted to carry on business in the state.

– Sales and Employer Taxes

If you have employees in your company, you need to register with the appropriate state tax authority.

8. File Annual reports

For filing annual reports, check out the rules in your state. However, the state needs LLCs to file an annual report with a filing fee. The fee can be as high as $800 per year depending on the state.

9. Out of State LLC registrations

If you want to learn how to acquire LLC in another state, you need to appoint a registered agent again. Also, check the state rules and regulations for opening a business, as they might be different.

So, you can go through these simple steps of forming an LLC for beginners alone, or you can do everything faster with the best LLC service provider. Let’s review the best options to form an LLC!

Best LLC Service Review 2023: ZenBusiness vs. Swyft Filings

image source: Unsplash

ZenBusiness and Swyft Filings both are the best incorporation and LLC service providers. Both provide the best services and are popular for LLC formation. However, there are a few key differences and similarities in their service. Let’s discuss a few of them.

ZenBusiness vs. Swyft Filings Similarities

- Both provide a way to start a new company

- They both have an online process, and no manual filling of papers is included

- Both of them help you to form a new corporation or LLC

- Both act as Registered Agent

- They help you draft all the essential documents of your business

- For your company, they provide ongoing services including annual report filing

- They also help you find business name-checking the availability of the name

- Both offer formation packages to choose from

- Both are excellent companies with customer reviews

Swyft filings vs ZenBusiness Differences

- Swyft Filings helps non-profit corporations as well, however, ZenBusiness cannot help non-profit corporations

- Swyft Filings services take a little longer, however, ZenBusiness provides quick turnover

- Swyft Filings charges more for Registered agent service

- Swyft Filings offers more extra services in terms of management, however, ZenBusiness has fewer services

ZenBusiness review

If you want to start an LLC for free, you should try Zen Business.

ZenBusiness is one of the best LLC service providers with excellent LLC services acknowledged by customers through 7310 reviews. It also has a good refund policy and canceling an account with a 60-day money-back guarantee. The services are provided in 50 states including DC. It provides free compliance services covering your annual filing. It’s quick and responds promptly. Customers also get two free amendments each year as part of the Worry-free Compliance service. Besides, it has a very good pricing plan, affordable, and with great features. The company gives 25% off on the first year of registered agent service.

Go to ZenBusinessZenBusiness Services Overview

ZenBusiness provides multiple services in LLC for beginners including its three plans. It also offers a special starter plan only for $49. At the end of the year, charge only $119 for the annual Report service. The company provides a digitally filed EIN with IRS. Overall, customers have the best reviews about its services. As one customer wrote,

“The service was so quick, so efficient, and more importantly, so worry-free.”

Another said,

“Excellent service, Emails about progress! Great customer service.”

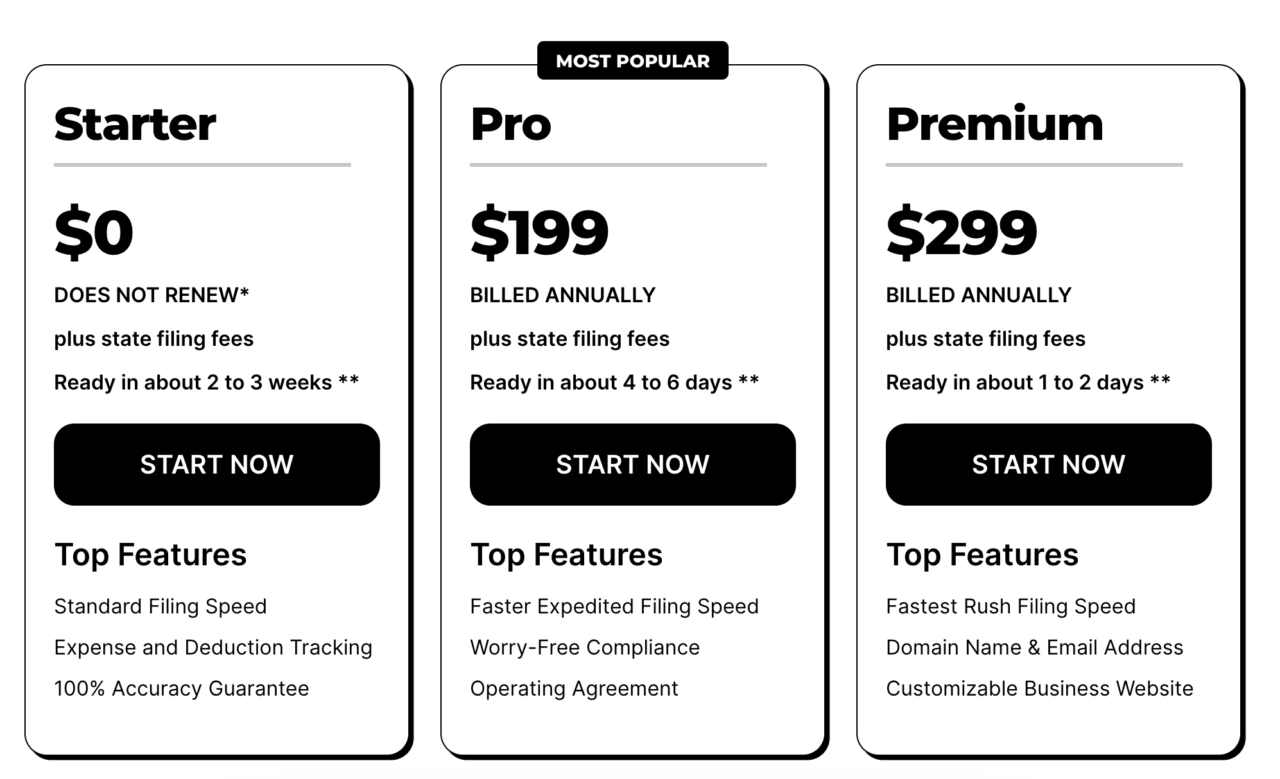

ZenBusiness Pricing packages

ZenBusiness Starter Plan features – $0

- Prepare and File LLC

- Standard filing Speed

- Annual Report Service

- Operating Agreement Template

- 100% Accuracy Guarantee

ZenBusiness Pro Plan features – $199

Besides the features of the starter, it adds more features including:

- Worry-Free Compliance

- Banking Resolution Template

- Employer ID Number ( EIN)

ZenBusiness Premium Plan – $299

Besides the features of Starter and Pro, Premium provides more services including:

- Business Website

- Business Domain Name

- Domain Name Privacy

- Business Email address

ZenBusiness Pluses

As a new company, it has provided incredible services and its strengths include the following:

- Easy-to-use website

- Affordable packages

- Offer free operating agreement under every package

- Customer satisfaction is high

- Socially conscious organization

- All-inclusive business formation service

ZenBusiness Minuses

Even though they have built themselves as a reputable business and provide excellent services, there are a few disadvantages:

- Recurring fee for registered agent service in the basic package

Swyft Filings review

Swyft Filings is the easiest LLC to start and the best place to create an LLC. It aims to save money and time by providing a fast turnaround. It’s a company that specializes in the formation of limited liability companies, corporations as well as non-profit organizations. It has been in the business of LLC since 2012 and has served thousands of new businesses. The company helps entrepreneurs by handling their business formation process. Additionally, it offers free accounting consultation and resources at a low price. The company is reliable for LLC formation.

Go to Swyft FilingsSwyft Filings Services Overview

Swyft Filings provides excellent services for its customers. The users’ reviews show that they are satisfied with the services. Swyftfilings provides services including name availability search, preparation of articles of organization, statement of incorporation, online access to documents, compliance card company alert system, bank resolution, custom meeting minutes, digital business kit and seal, electronic document delivery, FedEx shipping, and much more. One of the customers wrote,

‘’Calling and solving the problems didn’t take more time than I expected. The representative was very helpful and professional.’’

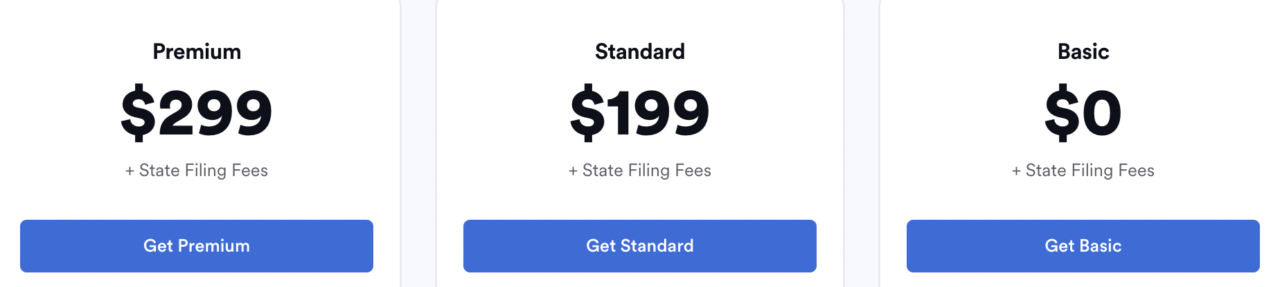

Swyft Filings Pricing packages

Swyftfiling Basic Plan Features – $0

- Verify availability of Company Name

- Prepare articles of organization

- Document filing

- Free statement of the organizer

- Online access to the documents

- Lifetime customer support

For other features, you have to pay the extra amount fixed.

Swyftfiling Standard Plan Features – $199

All the basic features are included, but it has some additional features:

- Obtain Federal Tax ID (EIN)

- Custom LLC operating agreement

- Custom LLC banking Resolution

- Custom organizational Minutes

For everything else, you have to pay a certain amount.

Swyftfiling Premium Plan Features – $299

Premium Plan includes all the features of basic and standard adding a few more services:

- Electronic Delivery of State Documents

- Customized Digital LLC kit

- Free business website and web hosting ( only for premium users)

Expediting options and shipping options depend on the state you choose.

Pluses

- It has an affordable pricing model with flexible services

- Personal and direct customer service

- Good turnover times

- Customer satisfaction is high

Minuses

- Excessive upselling

- Registered agent service not included with formation packages

LLC vs. Sole Proprietorship

LLC is a separate entity between you and your business’s debts and troubles. Its superpower? It means you, a business owner, aren’t on the hook for financial hiccups. The LLC takes the hit.

The sole proprietorship is like a one-person band where you call all the shots. But here’s the catch: there’s no protective shield. You and your business are one and the same. If trouble comes knocking, it’s knocking directly on your door.

To understand the differences between LLC and sole proprietorship, let’s go through the details:

1. Liability Protection

- LLC: Offers limited liability protection to its owners. It means members are generally not personally liable for business debts or legal actions against the company.

- Sole Proprietorship: Provides no liability protection. The owner is personally responsible for all business debts and legal liabilities.

2. Business Continuity

- LLC: Can continue to exist even if the owner/member leaves or passes away. Ownership can be transferred or sold.

- Sole Proprietorship: Ends if the owner decides to stop operating the business, becomes incapacitated or passes away.

3. Taxation

- LLC: Owners can choose to be taxed as a sole proprietorship (single-member LLC) or a partnership (multi-member LLC) by default.

- Sole Proprietorship: Business income is reported on the owner’s personal tax return, subject to individual tax rates.

4. Formalities and Compliance

- LLC: Requires more formalities, such as filing articles of organization, creating an operating agreement, and adhering to ongoing compliance requirements (e.g., annual reports).

- Sole Proprietorship: Generally has fewer formal requirements and compliance obligations.

5. Capital and Financing

- LLC: Easier access to capital through options like attracting investors or obtaining loans due to its formal structure.

- Sole Proprietorship: It may be challenging to secure external funding since it’s based on the owner’s personal credit and assets.

Sum Up

If you are looking for the best site to create an LLC, try ZenBusiness or Swyft Filings. The complicated registration and documentation process is handled by these companies accurately, authentically, and efficiently. Now you do not have to worry about the complex process if you are looking forward to opening your own single-member Company or corporation.

Meanwhile, it is essential to understand the basics of the services and charges that cost you to register your LLC.

I hope this information will guide you in your journey to register your business smoothly and without being worried.

Tetiana is a business coach and owner of IStartHub, a business media for ambitious female entrepreneurs and small business owners.